Assay Highlights:

24GF-1426: 586.7

g/t Au over 0.5 m (18.86

oz/t Au over 1.6 ft)

24GF-1424: 14.3 g/t Au

over 5.0 m (0.46 oz/t Au over 16.4 ft)

24GF-1397:

17.4 g/t Au over 4.2 m (0.56 oz/t Au over 13.8

ft)

22GF-1366: 8.8 g/t Au over

3.9 m (0.28 oz/t Au over 12.8 ft)

(See Figure

2. All assay values are true widths)

TORONTO, May 27, 2024 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:

MUX) (TSX: MUX) is pleased to provide new assay results from the Grey Fox deposit, part of our Fox Complex.

The results in Table 1 demonstrate intriguing explorations targets at depth and attractive near

surface gold grades with potential to be recovered utilizing lower cost open pit mining methods.

Gold at Grey Fox has been found in multiple zones, including Gibson,

Whiskey-Jack, 147 and Grey Fox South (GFS). The current resource estimate for Grey Fox is 1,168,000 oz gold

at a grade of 4.80 g/t Au Indicated and 236,000 oz gold at

4.35 g/t Au Inferred. An updated resource estimate will be completed in late September. Much of the

drilling performed in 2023 and continuing into 2024 was focused on increasing the existing resource in addition to

identifying new mineralized horizons.

Geological interpretations suggest that Grey Fox sits stratigraphically

above the mineralization of the Black Fox & Froome mines. Consequently, there is potential for deeper Black

Fox & Froome style mineralization directly below some of the Grey Fox zones. Historical production from these two

mines is more than 1,000,000 oz gold.

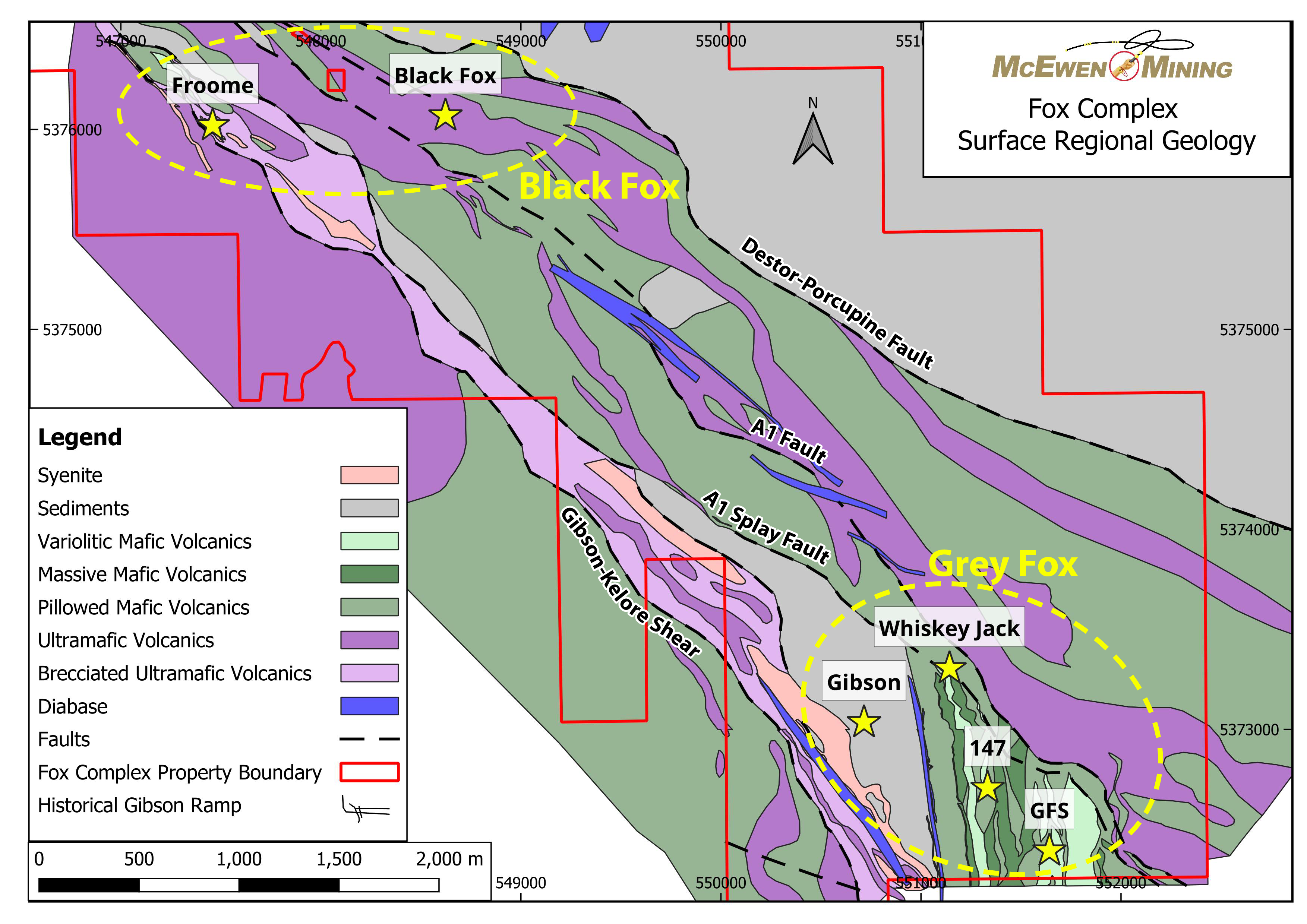

Figure 1 shows the location of the Grey Fox zones relative

to the Black Fox and Froome mines, on the same large property, separated by approximately 3 kilometers (1.9

miles). There has been limited drilling between Black Fox and Grey Fox, despite historical drill results that indicate

similar rock types associated with the A1 Fault, the principal structure that controls the mineralization at Black

Fox.

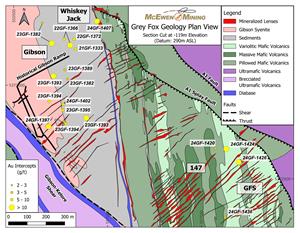

Gibson Zone

The Gibson zone has a history that made it an obvious target. A bulk sample

taken in 1989 had historical documentation suggesting an average gold grade in excess of 27 g/t Au.

Results from our recent drilling have established Gibson as a high priority target. The Gibson zone consists primarily

of a syenite intrusion with sediments lying to the East (see Figure 2). This geological setting is

similar to the Young-Davidson Mine, which has estimated gold reserves of about

3,300,000 oz gold at a grade of 2.3 g/t Au. This mine is located about 100

kilometers (62 miles) southwest of Grey Fox.

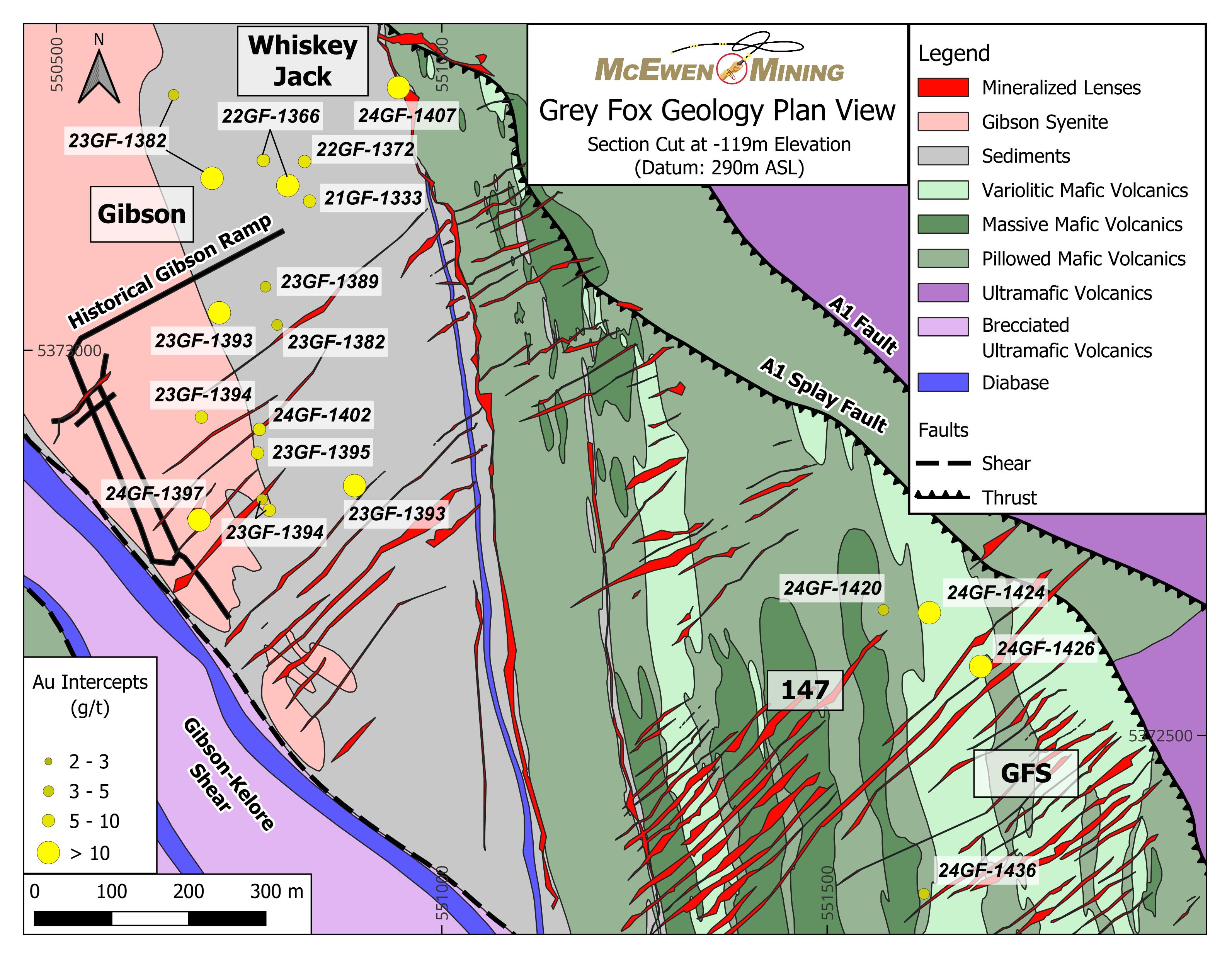

In Figure 2 we illustrate some of the newly received drill

intercepts at Gibson, which are conveniently located close to surface and close to the historical ramp used to take

the bulk sample (e.g., 22GF-1366: 8.8 g/t Au over 3.9 m and

24GF-1397: 17.4 g/t Au over 4.2 m). In addition, these results demonstrate

the potential for higher grading mineralization within the current resource.

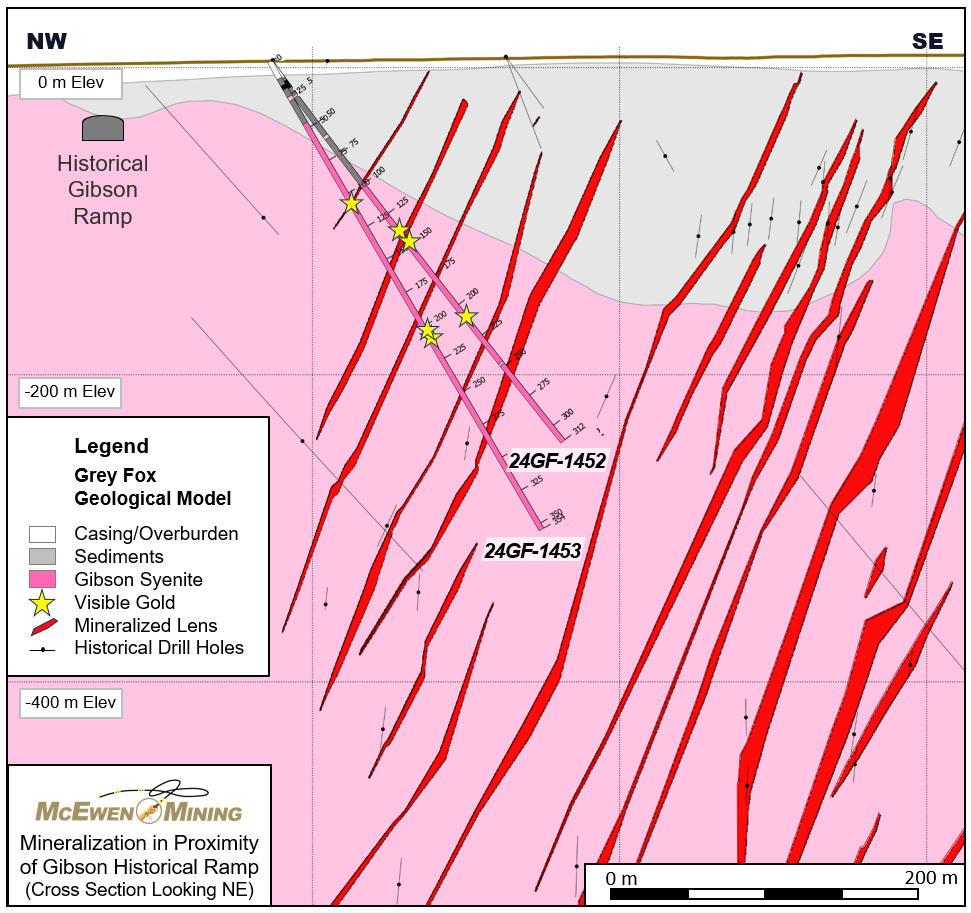

We have just commenced an aggressive follow-up infill program at Gibson,

designed to identify near-term mineralization. Figure 3 shows the first two holes (24GF-1452

and 24GF-1453; assays pending) for this program, drilled in proximity to the Gibson Ramp. Both drillholes

have multiple occurrences of visible gold (VG). Much of the VG is associated with existing mineralized lenses,

indicating the current resource model is performing well, i.e., the mineralization is being intersected where it is

anticipated to be present.

Earlier drilling in the sediments to the east of the Gibson syenite also

generated attractive assay results (e.g., 21GF-1333: 5.6 g/t Au over 10.2 m

from 386 m to 403.6 m downhole, at 365 m elevation), which shows the possible extension of favorable mineralization.

In addition, limited recent deep drilling at Gibson showed evidence for mineralization at depths greater than 600 m

(e.g., 23GF-1389: 4.4 g/t Au over 5.9 m within the Gibson syenite),

indicating the resource growth potential for the Grey Fox area. Many of the intercepts reported for the Gibson zone

are also open in most directions, including at depth.

Whiskey-Jack, GFS & 147 Zones

The Whiskey-Jack zone is the highest grading portion of the Grey Fox

deposit, with current Indicated resource of approximately 80,000 oz gold at a grade of 7.0

g/t Au and an Inferred resource of approximately 43,000 oz gold at a grade of

6.1 g/t Au. Located at the NW corner of the current Grey Fox resource, it is associated with a

local NW bend in the stratigraphy controlled by the A1 splay fault (see Figure 2). The A1 fault is

interpreted to extend from Black Fox south to Grey Fox and may mark the boundary between shallow Grey Fox style

mineralization and deeper-seated Black Fox style mineralization. A regional exploration campaign is currently underway

at Grey Fox to test for this deeper style of mineralization East of the A1 fault and to verify historical drilling,

which indicated mineralization in that area that could extend northwest back to Black Fox.

Geological interpretations suggests that the mineralization at Whiskey-Jack

extends from less than 50 m below surface down to a depth of at least 275 m and remains open at depth.

Two other targets are the GFS and 147 zones, located near the Southern edge

of the Grey Fox deposit. Figure 2 shows the locations of the newly received intercepts for

both zones. The better gold grades and intercept widths are generally located within the north-south oriented

variolitic mafic volcanics (e.g., 24GF-1426: 586.7 g/t Au over 0.5

m and 24GF-1424: 14.3 g/t Au over 5.0 m). This is

likely due to their enrichment in iron, which is a more favorable host rock and is a high priority target at GFS. The

very high-grade value seen in 24GF-1426 also warrants additional follow-up drilling. Mineralization at GFS

also begins at shallow depths (less than 50 m) and thus is amenable to open pit mining methods.

The following

features make Grey Fox a strong candidate for open pit mining:

- The gold grades are above average for an open pit mine;

- Relatively shallow overburden;

- Much of the gold mineralization identified starts at less than 50 m

below surface with the majority of the current resources less than 300 m below surface;

- Much of the mineralization is hosted in sub-parallel ‘stacked’

lenses located in proximity to each other with a steep (approx. 70°) dip, which means they are ideal for surface

mining, e.g., more optimal blasting patterns and less dilution, with a potentially low strip ratio.

An active exploration program will continue throughout the year and into

2025.

Figure 1 – Surface Plan View of the Geology for the Black Fox and

Grey Fox Deposits

Figure 2 – Plan View Map for the Grey Fox Area With Highlighted

Assay Intercepts

Figure 3 – Mineralization in Proximity of the Historical Gibson Ramp

(Cross Section Looking North-East)

Table 1 – Highlights of Recent Drill Intercepts From the Grey Fox

Exploration Program

|

Hole ID |

From

(m) |

To

(m) |

Core

Length

(m) |

True

Width

(m) |

True

Width

(ft) |

Au

Uncapped

(g/t) |

Au x TW

Uncapped

(GxM) |

|

21GF-1333* |

386.0 |

403.6 |

17.6 |

12.1 |

39.7 |

5.6 |

68.1 |

|

22GF-1366 |

151.8 |

157.4 |

5.7 |

3.9 |

12.8 |

8.8 |

34.5 |

|

And |

265.0 |

266.0 |

1.0 |

0.7 |

2.3 |

18.8 |

13.1 |

|

22GF-1372 |

229.1 |

231.0 |

1.9 |

1.2 |

3.9 |

7.3 |

8.4 |

|

23GF-1382 |

94.0 |

97.0 |

3.0 |

2.6 |

8.5 |

4.1 |

10.7 |

|

And |

276.5 |

279.0 |

2.5 |

2.2 |

7.2 |

10.2 |

22.2 |

|

And |

585.0 |

590.0 |

5.0 |

4.5 |

14.8 |

3.5 |

15.7 |

|

23GF-1389 |

714.0 |

722.0 |

8.0 |

5.8 |

19.0 |

4.4 |

25.7 |

|

23GF-1393 |

73.9 |

76.2 |

2.4 |

1.9 |

6.2 |

13.5 |

25.6 |

|

And |

216.0 |

216.6 |

0.6 |

0.5 |

1.6 |

17.1 |

8.4 |

|

And |

649.0 |

650.0 |

1.0 |

0.8 |

2.6 |

18.2 |

15.3 |

|

23GF-1394 |

375.6 |

378.0 |

2.4 |

2.0 |

6.6 |

6.4 |

12.8 |

|

And |

563.0 |

576.7 |

13.7 |

11.8 |

38.7 |

2.8 |

33.2 |

|

And |

590.0 |

597.0 |

7.0 |

2.3 |

7.5 |

8.2 |

18.8 |

|

23GF-1395 |

612.0 |

615.0 |

3.0 |

2.4 |

7.9 |

7.2 |

17.4 |

|

24GF-1397 |

151.0 |

157.0 |

6.0 |

4.2 |

13.8 |

17.4 |

73.1 |

|

24GF-1402 |

189.0 |

191.0 |

2.0 |

1.3 |

4.3 |

7.7 |

9.9 |

|

24GF-1407 |

316.9 |

322.2 |

5.3 |

1.2 |

3.9 |

10.3 |

12.6 |

|

24GF-1420 |

280.0 |

286.5 |

6.4 |

5.0 |

16.4 |

4.1 |

20.7 |

|

24GF-1424 |

95.0 |

101.4 |

6.4 |

5.0 |

16.4 |

14.3 |

71.4 |

|

24GF-1426 |

200.3 |

200.9 |

0.7 |

0.5 |

1.6 |

586.7 |

274.1 |

|

24GF-1436 |

187.0 |

190.2 |

3.2 |

2.3 |

7.5 |

4.1 |

9.3 |

* - Previously reported drill results

Technical Information

Technical information pertaining to the Fox Complex exploration contained in this news release has

been prepared under the supervision of Sean Farrell, P.Geo., Chief Exploration Geologist, who is a Qualified Person as

defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral

Projects."

The technical information related to resource and reserve estimates in this news release has been

reviewed and approved by Luke Willis, P.Geo., McEwen Mining’s Director of Resource Modelling and is a Qualified Person

as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure

for Mineral Projects."

Exploration drill core samples at Grey Fox were typically submitted as 1/2 core. Analyses reported

herein were performed either by the fire assay method at the accredited laboratories: Pangea Laboratorio in Sinaloa,

Mexico (NMX-EC-17025-IMNC-2018, ISO /IEC 17025:2017), owned and operated by an indirect subsidiary of the Company, ACT

Labs (ISO 9001 & ISO 17025:2017), ALS laboratory (ISO 9001 & ISO 17025:2017), or by the photon assay method at

the accredited laboratory MSA Labs (ISO 9001 & ISO 17025) in Timmins, Ontario, Canada.

For a list of drilling results at Grey Fox since Nov 28, 2022, including hole location and

alignment, click here:

https://www.mcewenmining.com/files/doc_news/archive/2024/2024_05_Grey_Fox_drill_results.xlsx

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The

forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the

"Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking

statements and information are necessarily based upon a number of estimates and assumptions that, while considered

reasonable by management, are inherently subject to significant business, economic and competitive uncertainties,

risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate.

Therefore, actual results and future events could differ materially from those anticipated in such statements and

information. Risks and uncertainties that could cause results or future events to differ materially from current

expectations expressed or implied by the forward-looking statements and information include, but are not limited to,

effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks,

political, economic, social and security risks associated with foreign operations, the ability of the corporation to

receive or receive in a timely manner permits or other approvals required in connection with operations, risks

associated with the construction of mining operations and commencement of production and the projected costs thereof,

risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on

forward-looking statements or information included herein, which speak only as of the date hereof. The Company

undertakes no obligation to reissue or update forward-looking statements or information as a result of new information

or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, and other filings with the Securities and Exchange Commission, under the

caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the

forward-looking statements and information regarding the Company. All forward-looking statements and information made

in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy

of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina.

McEwen Mining also holds a 47.7% interest in McEwen Copper, which is developing the large, advanced-stage Los Azules

copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the

objective of increasing the share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has a personal

investment in the Company of US$220 million.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news

as it happens!

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/07f25f5f-cfaa-4171-a18e-5c9b2dc22f51

https://www.globenewswire.com/NewsRoom/AttachmentNg/efca557c-ba5a-470a-b28c-1541956dd1cb

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb7f45f8-70ab-4f3d-9971-0ca104bdef8f

Figure 1 – Surface Plan View of the Geology for the Black Fox and Grey Fox Deposits

Figure 2 – Plan View Map for the Grey Fox Area With Highlighted Assay Intercepts

Figure 3 – Mineralization in Proximity of the Historical Gibson Ramp (Cross Section Looking North-East)

Source: McEwen Mining